Jumbo Loan Boundaries: How Much Can You Borrow for a High-End Home?

Jumbo Loan Boundaries: How Much Can You Borrow for a High-End Home?

Blog Article

Navigating the Intricacies of Jumbo Finance Options to Locate the Right Suitable For Your Demands

Navigating the intricacies of jumbo financing alternatives can be a overwhelming however essential step for those looking for to finance a high-value residential or commercial property. With a myriad of loan types-- ranging from fixed-rate to interest-only and adjustable-rate-- each choice provides prospective risks and distinct benefits. Comprehending exactly how rate of interest and deposit needs fluctuate in between these choices is critical. Evaluating your financial standing, consisting of credit report scores and debt-to-income ratios, plays an essential role in protecting beneficial terms. How do you make sure that your option aligns perfectly with your long-term monetary aspirations? Consider the following understandings.

Recognizing Jumbo Financings

A thorough understanding of big lendings is necessary for navigating the facility landscape of high-value actual estate financing. Unlike traditional car loans, big car loans are developed for buildings that surpass the Federal Housing Money Agency's adjusting finance limits. These restrictions differ by region, reflecting local real estate market problems, but typically go beyond $726,200 in a lot of locations since 2023. Such fundings are important for buying high-end homes or buildings in high-cost areas where conventional funding fails - jumbo loan.

Jumbo lendings include distinct underwriting requirements, usually requiring more strict credit report criteria. Debtors are generally expected to demonstrate a robust credit report, usually 700 or greater, to certify. In addition, lenders often mandate a lower debt-to-income proportion, often not going beyond 43%, to guarantee the customer can manage the bigger financial commitment. A significant down repayment, commonly ranging from 10% to 30%, is also a typical requirement, showing the lender's increased threat exposure.

Rates of interest on jumbo finances might differ substantially, often somewhat greater than those for adapting loans, due to the boosted risk and absence of government backing. Comprehending these subtleties is vital for consumers intending to secure financing customized to high-value actual estate transactions.

Comparing Financing Types

Big fundings, usually needed for funding buildings that surpass traditional car loan restrictions, come in numerous types, each with distinct features customized to details debtor accounts. Fixed-rate big car loans are often preferred for their predictability, supplying a regular interest price and month-to-month settlement throughout the funding tenure, which can ease budgeting worries.

On the other hand, adjustable-rate big lendings (ARMs) offer first periods of reduced rate of interest, commonly making them an attractive option for debtors who prepare for marketing or refinancing before the rate adjusts. The main attraction right here is the potential for considerable savings throughout the initial set duration, although they lug the danger of rate boosts in time.

Interest-only big car loans existing another choice, enabling borrowers to pay just the interest for a specified duration. This alternative can be useful for those looking for lower initial payments or who expect a significant earnings increase in the future. Each finance type has one-of-a-kind advantages and potential disadvantages, making mindful factor to consider vital to aligning with lasting financial strategies.

Reviewing Rates Of Interest

Passion prices play a crucial function in determining the general cost of a big funding, making their evaluation a critical part of the home loan choice process. In the context of big financings, which are not backed by government-sponsored entities and often involve greater quantities, rate of interest can differ much more significantly than with adapting fundings. This variant demands a detailed understanding of exactly how rates are established and their lasting monetary impact.

The rates of interest on a big financing is affected by numerous variables, consisting of the lending institution's plans, market conditions, and the debtor's credit reliability. Lenders commonly examine the customer's credit report, debt-to-income ratio, and monetary books to establish the price. It's important for borrowers to contrast rates from different lenders to ensure they protect the most positive terms.

Repaired and variable-rate mortgages (ARMs) use different rate of interest frameworks that can affect payment stability and total lending expenses - jumbo loan. A fixed-rate finance provides consistency with predictable monthly settlements, whereas an ARM might use a reduced initial price with prospective adjustments with time. Evaluating these choices in the context of existing interest fads and individual economic goals is vital for maximizing the cost-effectiveness of a big car loan

Assessing Down Payment Requirements

Unlike traditional car loans, jumbo loans normally call for a greater down settlement due to their dimension and danger account. Lenders often established the minimum down payment for big fundings at 20%, yet this can change based on variables such as credit score, finance quantity, and the building's place.

The deposit not only impacts the dimension of the car loan however also influences the interest price and private home mortgage insurance coverage (PMI) obligations. A larger down repayment can lead to a lot more positive car loan terms and possibly remove the demand for PMI, which is commonly needed when the down settlement is less than 20%. Consequently, consumers must consider their monetary capability when establishing the proper deposit.

Additionally, some lenders may provide flexibility in down settlement alternatives if borrowers can show solid financial health and wellness, such as significant cash gets or a superb credit rating history. Possible big financing customers ought to carefully assess these variables to maximize their mortgage method.

Choosing the Right Lender

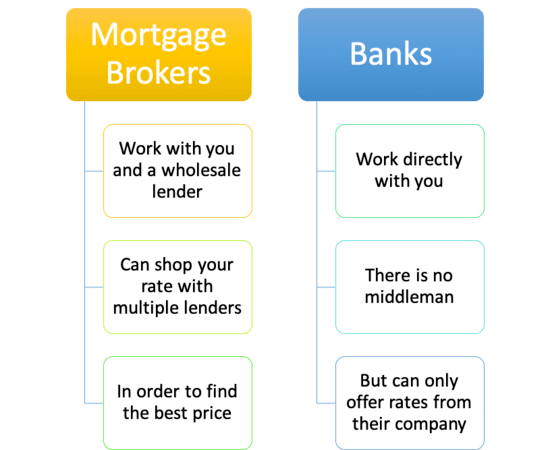

Choosing the best loan provider for a jumbo funding is a crucial choice that can substantially affect the terms and success of your mortgage. Jumbo lendings, often exceeding the adapting lending limits, existing unique obstacles and opportunities that necessitate mindful consideration when selecting a borrowing companion. A lender's experience with big loans, adaptability in underwriting, and competitive rate of interest are vital factors that ought to right here be thoroughly reviewed.

Developed lenders with a history of successful jumbo car loan processing can offer important insights and smoother deals. Considering that big loans are not standardized like conventional finances, a lender that provides customized services and items can much better align with your monetary goals.

Furthermore, openness in charges and communication is necessary. Guarantee that possible loan providers clearly detail all connected expenses, conditions, and terms. Involving with loan providers that prioritize clear communication can stop misunderstandings and unexpected economic burdens. Lastly, contrast several loan providers to gauge affordable rate of interest and terms. A thorough comparison will certainly empower you to make a notified decision, guaranteeing that the picked loan provider sustains your financial purposes properly.

Conclusion

Navigating the intricacies of jumbo lending options necessitates a detailed assessment of financing kinds, rate of interest prices, and down settlement demands. Aligning car loan features with long-lasting monetary goals makes sure notified decision-making, eventually facilitating the choice of a lending that ideal satisfies individual demands and situations.

Unlike conventional lendings, jumbo car loans are developed for properties that exceed the Federal Real estate Money Firm's adapting finance limits. Fixed-rate jumbo car loans are frequently preferred for their predictability, using a regular rate of interest rate and regular monthly payment throughout the funding tenure, which can reduce budgeting worries. In the context of More about the author jumbo car loans, which are not backed by government-sponsored entities and usually entail greater quantities, interest rates can vary much more substantially than with conforming lendings. Since big loans are not standardized like conventional loans, a lender that offers tailored continue reading this products and services can much better align with your financial goals.

Report this page